Your Financial Life, Orchestrated.

Across all the places your money lives.

Your Financial Life Lacks Coordination

The most awkward moment in payments:

‘Sorry, we don’t accept that.’

No Clear Picture

Your money lives across banks and accounts.

Seeing the full picture takes effort.

Manual Decisions

Choosing the right account takes thought.

Every decision relies on memory.

Too Much Exposure

Statements don’t support selective sharing.

It’s either everything or nothing.

A Better Way to Coordinate Your Money

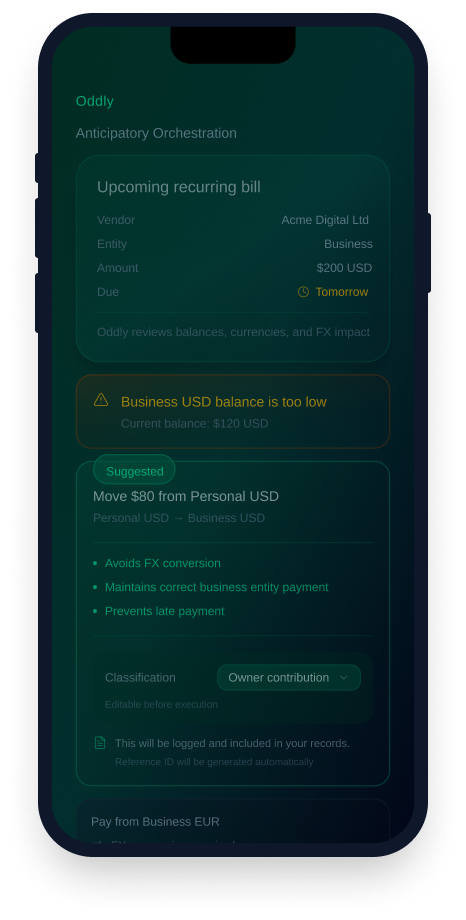

Built-In Context

Know which account or currency makes sense.

Decisions are informed, not remembered

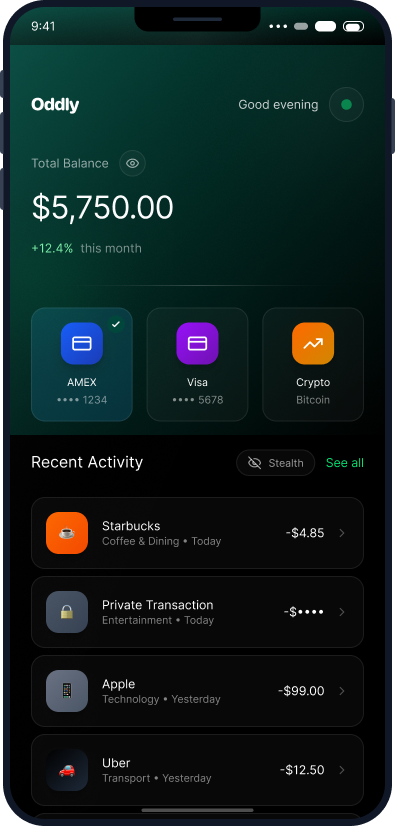

Choose

Pick the card or crypto you want to pay with. Keep your points, keep your perks.

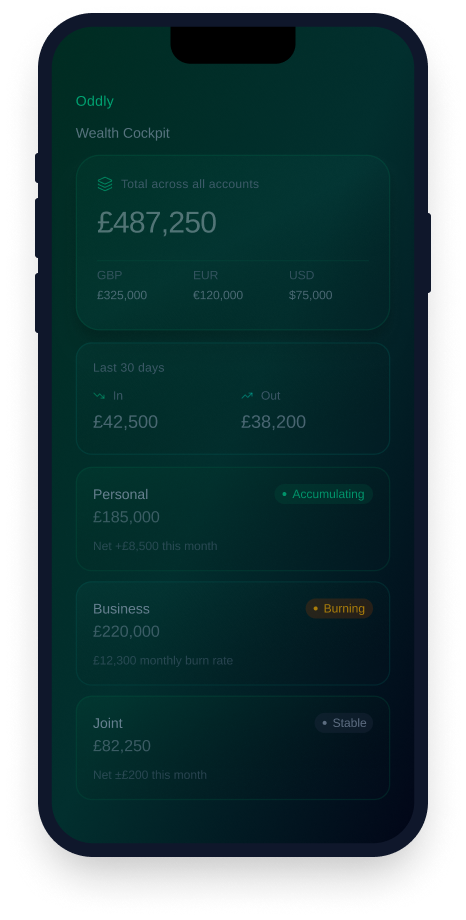

One Clear View

See all your accounts and balances in one place.

Across personal, business, joint accounts, and currencies.

Tap

Use your Oddly card or Apple/Google Pay as usual.

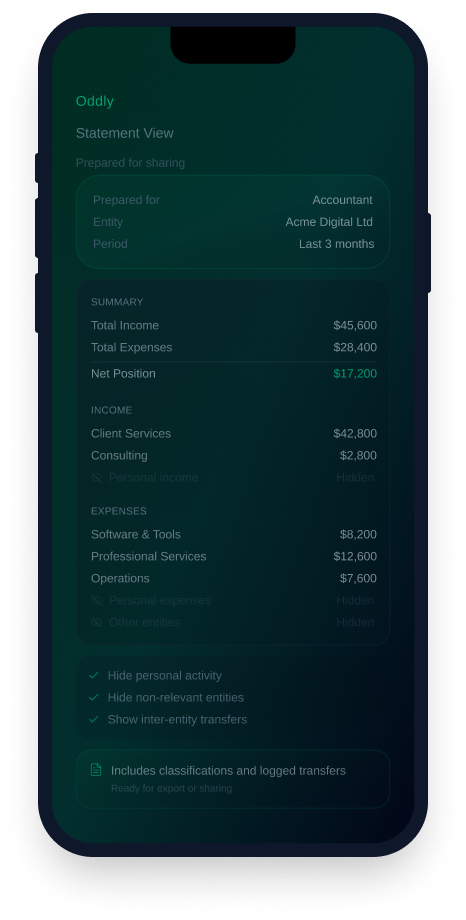

Selective Sharing

Handled

Share only what’s relevant with the right people.

Nothing more than necessary, nothing you don’t intend.

We handle the rest

Handled

We enable private, seamless crypto payments for everyday spending.

Join & Refer

All verified members get 6 months of Oddly Premium when we launch.

Founding Access

Get early access to Oddly before public launch, with priority onboarding and guided setup.

This isn’t a waitlist. It’s early entry into a new way of coordinating wealth.

Shape the Product

Founding members directly influence workflows, exports, and orchestration logic.

Built alongside people with real financial complexity, not mass-market assumptions.

Permanent Benefits

Receive 6 months of Oddly Premium at launch, preferred pricing thereafter, and access to founder-only features.

Benefits that compound as the platform grows.

Be part of the future of payments — exclusive early access for the first 1,000.

Frequently Asked Questions

We’d rather answer them properly.

You can reach us directly at: hello@oddlyfinance.com

Request founding access via the site.

If you’re a good fit, you’ll be invited to join the founding cohort as access opens.

Most tools either:

Oddly is focused on coordination:

We optimise how everything works together, not individual pieces in isolation.

We’re starting in the UK due to open banking maturity and regulatory clarity.

International support — including EU, UAE, and other global hubs — is part of the roadmap.

Founding members will be prioritised as new regions launch.

No.

Joining the waitlist is free and carries no obligation.

You’ll only be invited to onboard when access becomes available.

Founding members receive:

Most importantly, you help shape how Oddly works for real-world complexity.

Oddly is currently pre-launch.

We are onboarding a founding cohort first, before opening access more broadly.

Founding members get:

Security and trust are foundational.

Oddly is designed to be read-first, control-focused, and regulator-friendly.

Yes — that’s a core design principle.

Oddly creates clean, structured views that highlight what matters and hide what doesn’t.

Exports clearly show:

This makes life easier for accountants, advisors, lenders, and applications.

Oddly is built to respect entity boundaries.

Personal, business, and joint finances are treated separately, even when viewed together.

When money moves between entities, Oddly:

Nothing is silently mixed or hidden.

At launch, Oddly focuses on visibility, context, and orchestration, not automatic execution.

We highlight what makes sense, explain why, and log decisions properly — you remain in control.

Payment initiation and more advanced flows may be introduced later, depending on regulation and demand.

Oddly uses regulated open banking providers to securely connect to your accounts.

- No credentials are stored

- Connections are permission-based

- You stay in full control at all times

At launch, Oddly will focus on UK accounts first, with additional regions added over time.

No.

Oddly is not a bank, neobank, or card provider.

We do not hold your money. We sit above your existing banks and accounts to provide clarity, context, and control.

Oddly is designed for people whose money lives in more than one place, such as:

- Founders and operators with multiple business accounts

- Global professionals and remote earners

- Expats and people living across borders

- Anyone managing personal, business, or joint finances together

If you have one bank account and simple finances, Oddly is probably not for you.

Oddly is building a wealth orchestration layer for people with complex financial lives.

We bring together accounts, entities, and currencies into a single cockpit, add context to financial decisions, and help you share clean, intentional financial views without oversharing.

Oddly does not replace your banks, it coordinates them.

Oddly is building a wealth orchestration layer for people with complex financial lives.

We bring together accounts, entities, and currencies into a single cockpit, add context to financial decisions, and help you share clean, intentional financial views without oversharing.

Oddly does not replace your banks, it coordinates them.

Oddly is designed for people whose money lives in more than one place, such as:

- Founders and operators with multiple business accounts

- Global professionals and remote earners

- Expats and people living across borders

- Anyone managing personal, business, or joint finances together

If you have one bank account and simple finances, Oddly is probably not for you.

No.

Oddly is not a bank, neobank, or card provider.

We do not hold your money. We sit above your existing banks and accounts to provide clarity, context, and control.

Oddly uses regulated open banking providers to securely connect to your accounts.

- No credentials are stored

- Connections are permission-based

- You stay in full control at all times

At launch, Oddly will focus on UK accounts first, with additional regions added over time.

At launch, Oddly focuses on visibility, context, and orchestration, not automatic execution.

We highlight what makes sense, explain why, and log decisions properly — you remain in control.

Payment initiation and more advanced flows may be introduced later, depending on regulation and demand.

Oddly is built to respect entity boundaries.

Personal, business, and joint finances are treated separately, even when viewed together.

When money moves between entities, Oddly:

Nothing is silently mixed or hidden.

Yes — that’s a core design principle.

Oddly creates clean, structured views that highlight what matters and hide what doesn’t.

Exports clearly show:

This makes life easier for accountants, advisors, lenders, and applications.

Security and trust are foundational.

Oddly is designed to be read-first, control-focused, and regulator-friendly.

Oddly is currently pre-launch.

We are onboarding a founding cohort first, before opening access more broadly.

Founding members get:

Founding members receive:

Most importantly, you help shape how Oddly works for real-world complexity.

No.

Joining the waitlist is free and carries no obligation.

You’ll only be invited to onboard when access becomes available.

We’re starting in the UK due to open banking maturity and regulatory clarity.

International support — including EU, UAE, and other global hubs — is part of the roadmap.

Founding members will be prioritised as new regions launch.

Most tools either:

Oddly is focused on coordination:

We optimise how everything works together, not individual pieces in isolation.

Request founding access via the site.

If you’re a good fit, you’ll be invited to join the founding cohort as access opens.

We’d rather answer them properly.

You can reach us directly at: hello@oddlyfinance.com

Join the Waitlist Now

Your golden ticket to the inside.

Earn 2 months of Premium, unlock early access, and race for one of 1,000 Founder’s Cards before they’re gone.